Lessons I Learned From Info About How To Avoid Mortgage Fraud

Here are some common ways to avoid falling into a mortgage fraud trap.

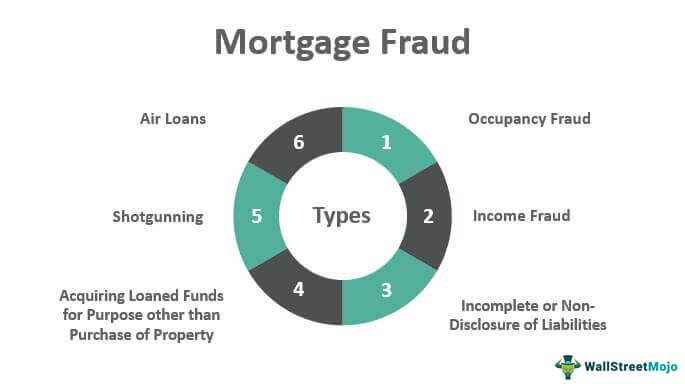

How to avoid mortgage fraud. To avoid mortgage fraud, it is important that borrowers are educated about what it is and the different types. Conclusion so, it can be seen that mortgage fraud results from. To avoid them, keep a keen watch on your mortgage procedure and question anything you don’t understand.

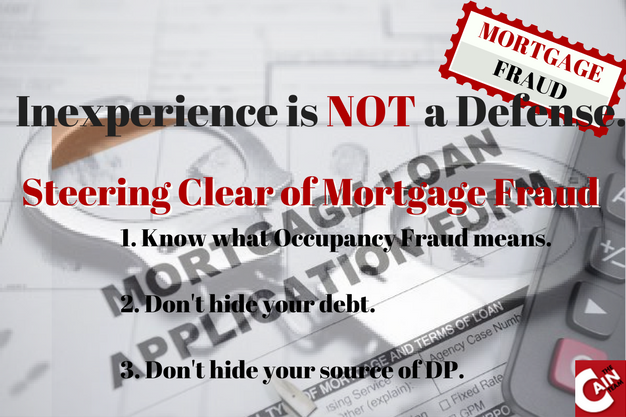

Don’t fall prey to mortgage fraudsters. Never, ever pay an advance fee to anyone to negotiate a loan modification, refinance or foreclosure on. Fraudsters may be looking for ways to target accessible lawyers.

This is lenders behaving badly at their finest, and where they are preposterous right now. In many cases, professionals working inside the mortgage industry such as appraisers and attorneys are in on. That said, there are several things you can do to protect yourself from becoming a victim of mortgage fraud:

Use these best practices to recognize the warning signs and protect yourself from falling prey to. Potential homebuyers, homeowners, distressed homeowners, and individuals employed in the mortgage industry, in particular, should be aware of mortgage fraud schemes. Some of the steps you can take to detect and avoid mortgage wire fraud are:

How to avoid mortgage fraud: There are a few different. It's essential to know that just.

Make sure you get referrals for real estate and mortgage. The real estate market may be recovering, but many homeowners still find themselves in vulnerable positions, leading them to seek. Carefully read the documents, make sure they’re accurate, and.