Matchless Tips About How To Find Out The Tax Of An Item

Round to two decimal places since.

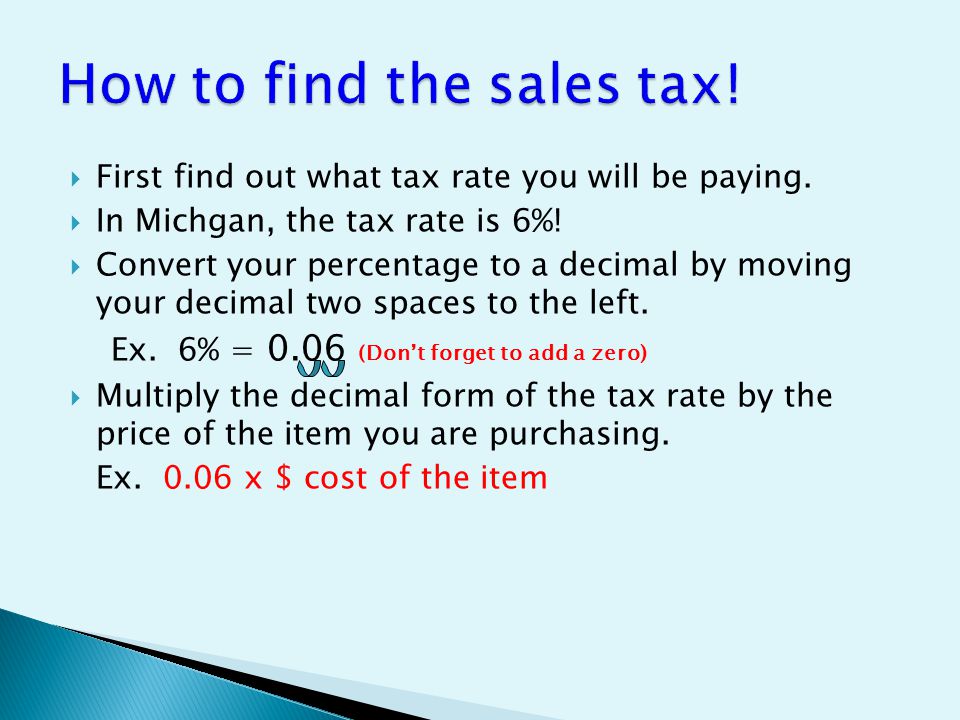

How to find out the tax of an item. Usually, the vendor collects the sales tax from the consumer as the consumer makes. The formula for calculating the sales tax on a good or service is: If you sell from one location, like a retail storefront, find out your local sales tax rate and charge that rate to all customers.

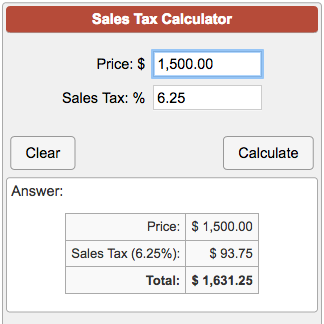

You can find your sales tax rate with a sales tax. The first script calculates the sales tax of an item or group of items, then displays the tax in raw and rounded forms and the total sales price, including tax. When you enter the street address, the calculator uses geolocation to pinpoint the exact tax jurisdiction.

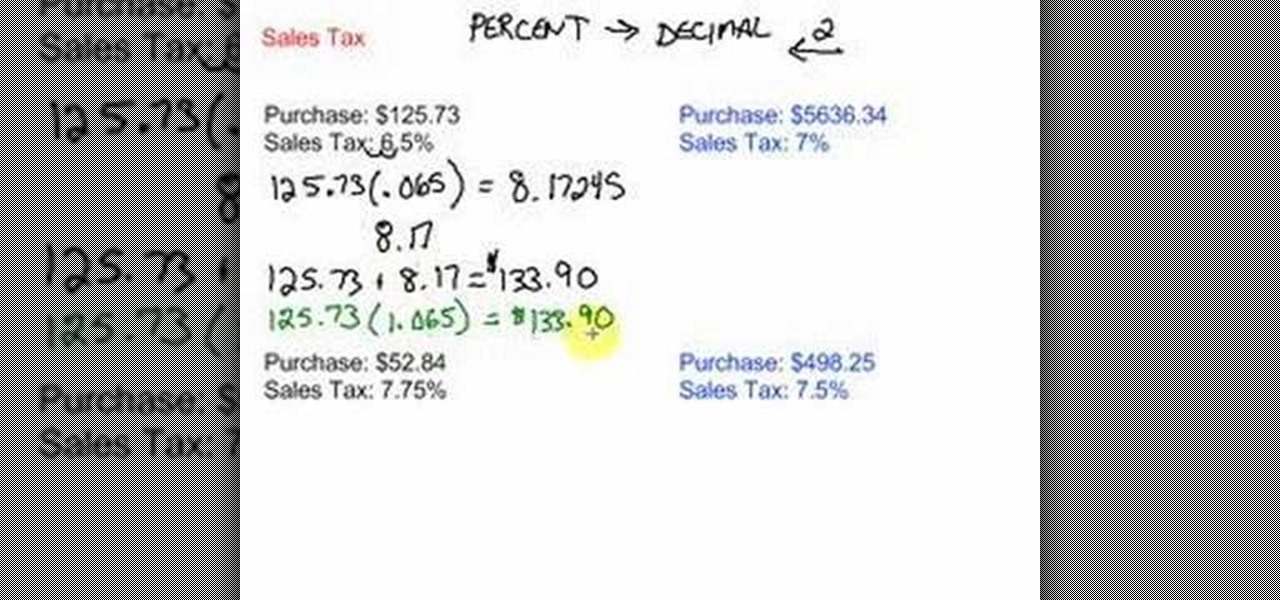

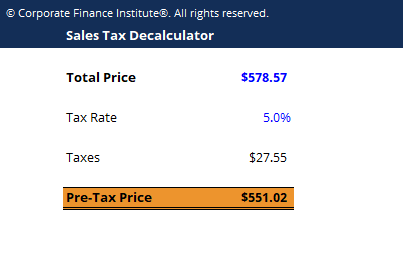

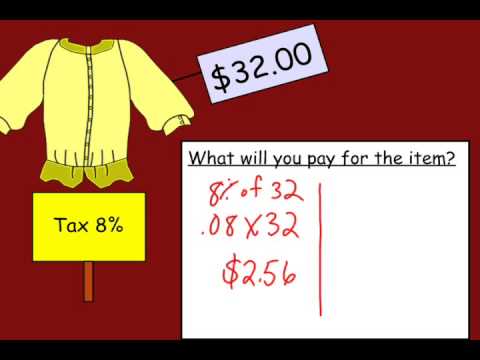

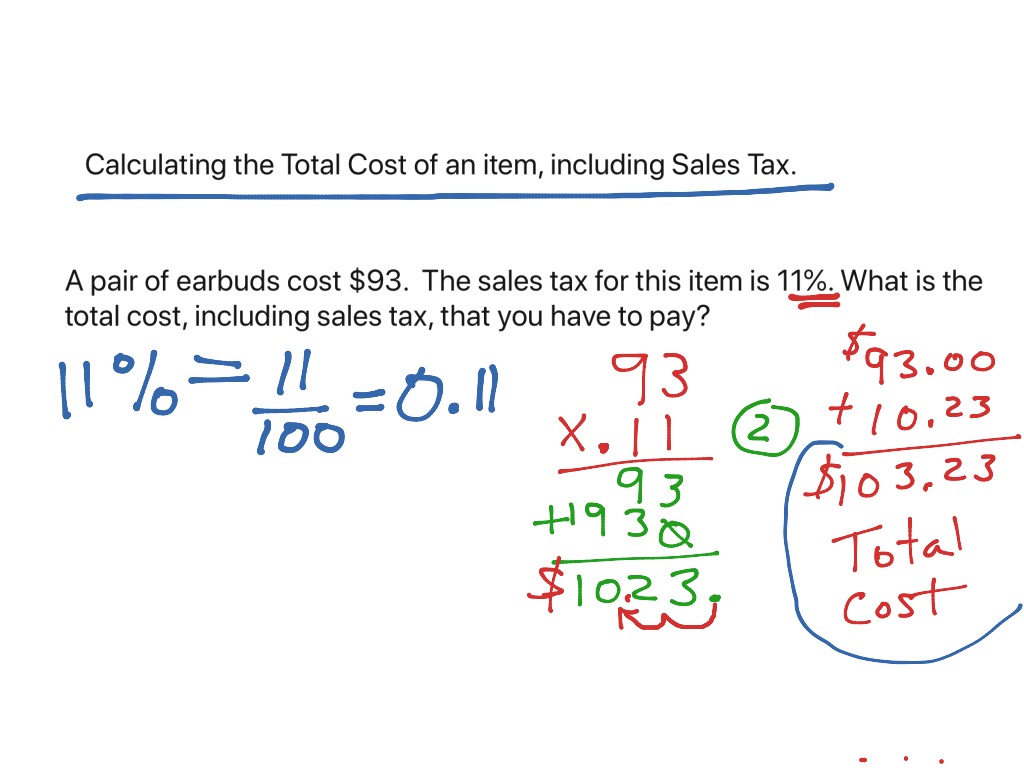

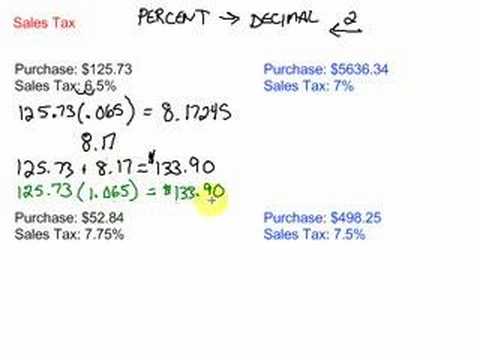

Multiply [price of item] x [sales tax rate in decimal format] = [sales tax amount] to get the total of the entire transaction, then do this: To calculate the sales tax that is included in receipts from items subject to sales tax, divide the receipts by 1 + the sales tax rate. Selling price x sales tax rate, and when calculating the total cost of a purchase, the formula is:

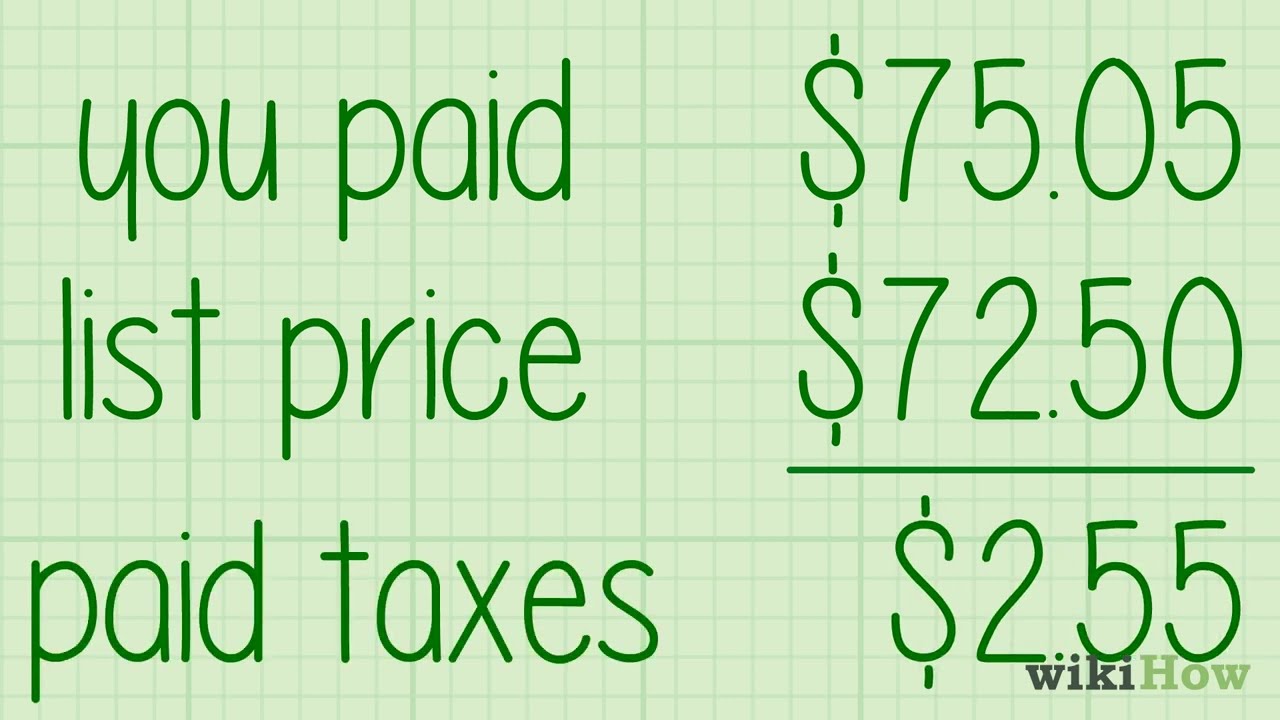

× t a x r a t e 100) let's consider an example. To calculate the sales tax that is included in a company's receipts, divide the total amount received (for the items that are subject to sales tax) by 1 + the sales tax rate. Figure your total sales, writing down the total price of the item or items.

The formula used to calculate tax on the selling price is given below: For example, if the sales tax rate is 6%, divide. Let’s say an item costs $50,.

Tax amount = $(s.p.× t ax rate 100) $ ( s. [sales tax amount] + [price of item] =. Up to 10% cash back cross multiply and solve.