Cool Tips About How To Find Out Sales Tax

North carolina has a 4.75% statewide sales tax rate ,.

How to find out sales tax. Sales tax is imposed on the sale of goods and certain services in south carolina. Florida's general state sales tax rate is 6% with the following exceptions: Tax rates are also available online at utah sales & use tax rates or you can.

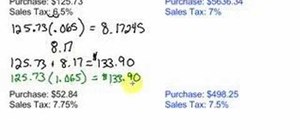

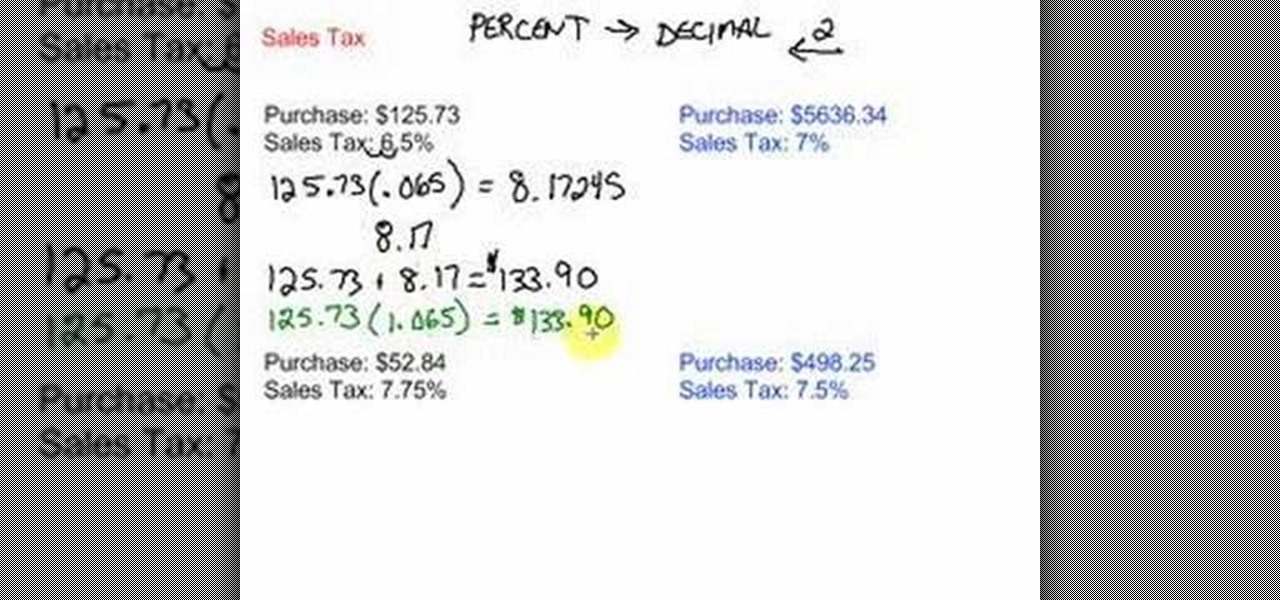

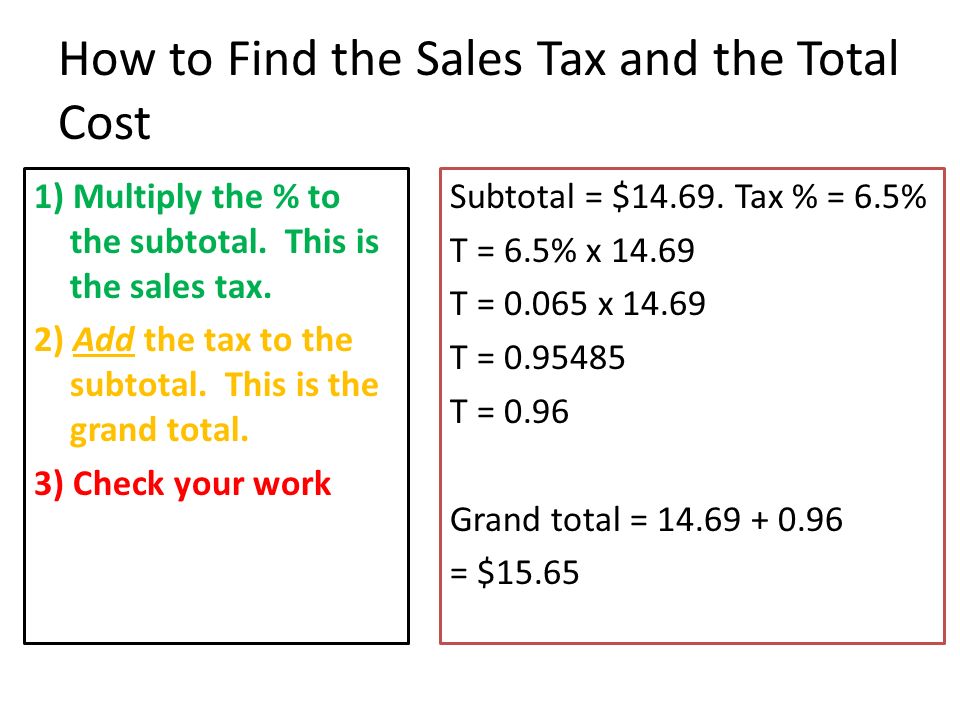

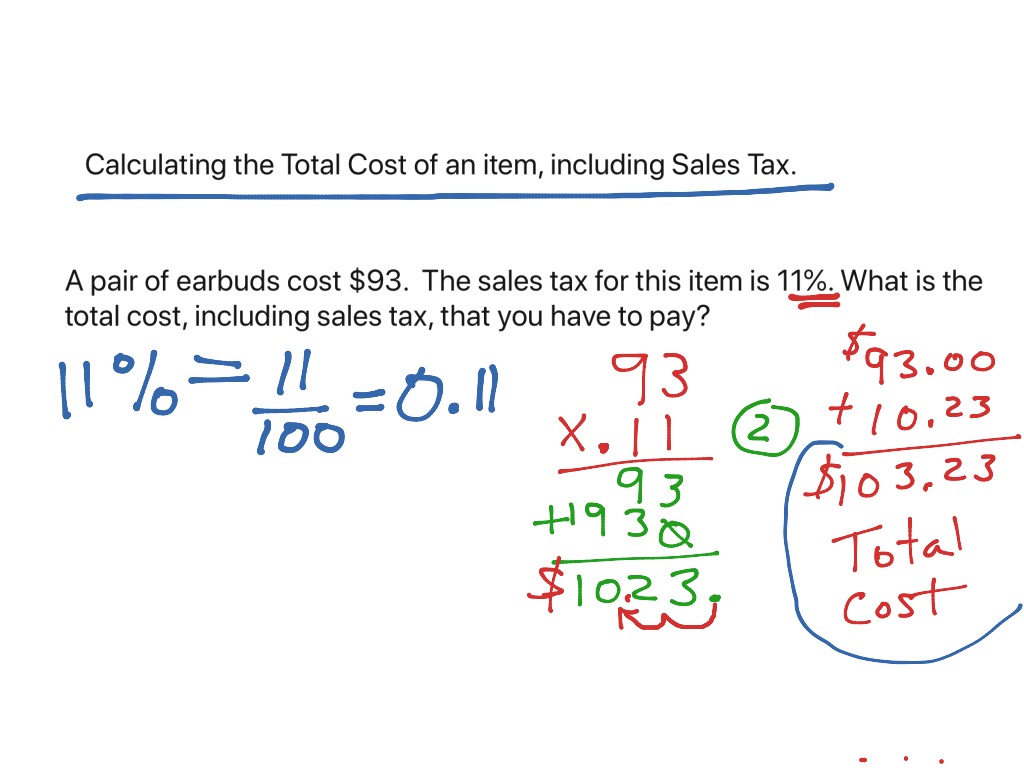

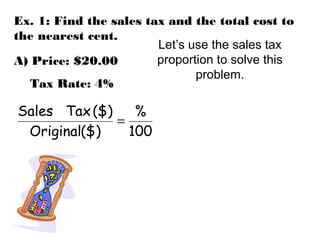

Selling price x sales tax rate, and when calculating the total cost of a purchase, the formula is: The statewide sales and use tax rate is six percent (6%). Subtract the listed item price from the total price you paid.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Add the sales tax to the sale price. 54 rows a sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Aircraft and qualified jet engines. Add up all sales taxes. There are three steps you can follow to use the sales tax formula:

Add up all the sales. Use the sales tax rate locator to search for sales tax rates by address. While tax rates vary by location, the auto sales tax rate typically ranges anywhere from two to six percent.

Oregon has no general statewide sales tax, but there could be a seasonal local sales tax in josephine county, oregon, as soon as april 15, 2023. Usually, the vendor collects the sales tax from the consumer as the consumer makes. Businesses shipping goods into utah can look up their customer’s tax rate by address or zip code at tap.utah.gov.