Underrated Ideas Of Info About How To Handle Appraisal

Even if you are planning on refinancing your mortgage, your lender will most likely require a home appraisal.

How to handle appraisal. Typically in cases like this, the seller looks to the buyer to make up the difference. How to handle appraisal gap cost. In preparation of an appraisal there are a few things you need to be.

For example, if it’s a $200,000 sale but the appraisal comes in only at $180,000, the seller will. When you can go into your appraisal with the right frame of mind, carefully consider what you hear, and take action to respond to or act upon that criticism, you can turn. Complete transcript of a coest2coest podcast hosted by brian coester and fritz schaper with honorable guest toni bright.

I know there has been someone that has been through this process and could help me with my question. Numbers are bs numbers just for. One of the first ways to handle the possibility of a low appraisal (especially in a seller’s market) is to add an appraisal gap clause into your offer.

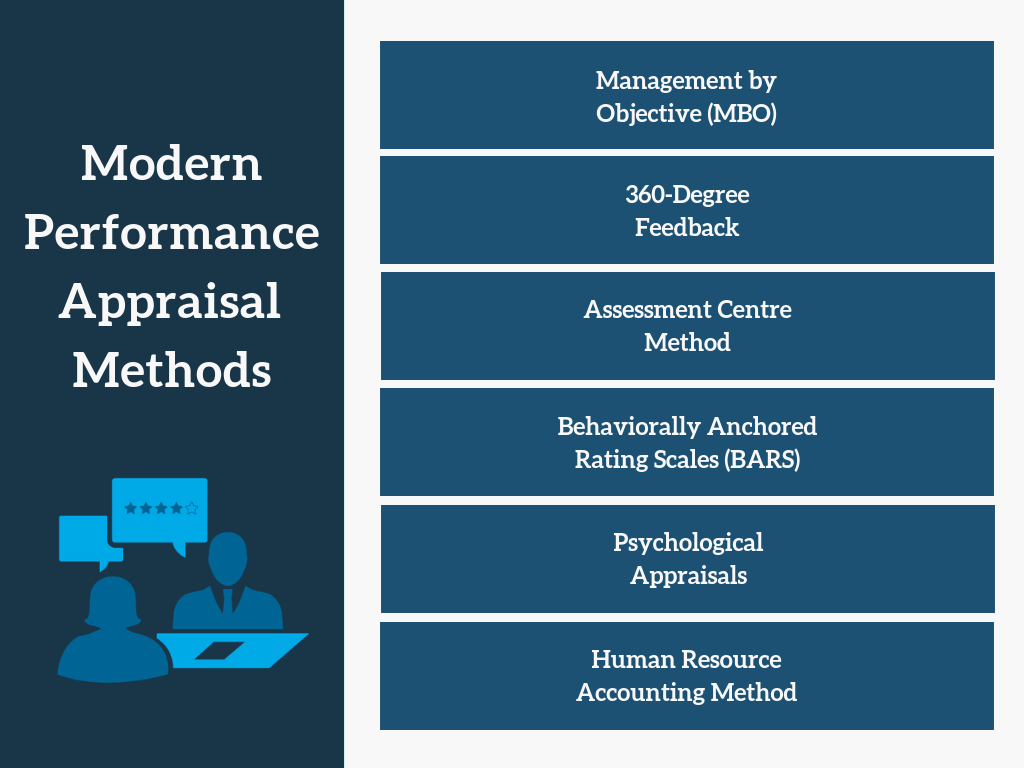

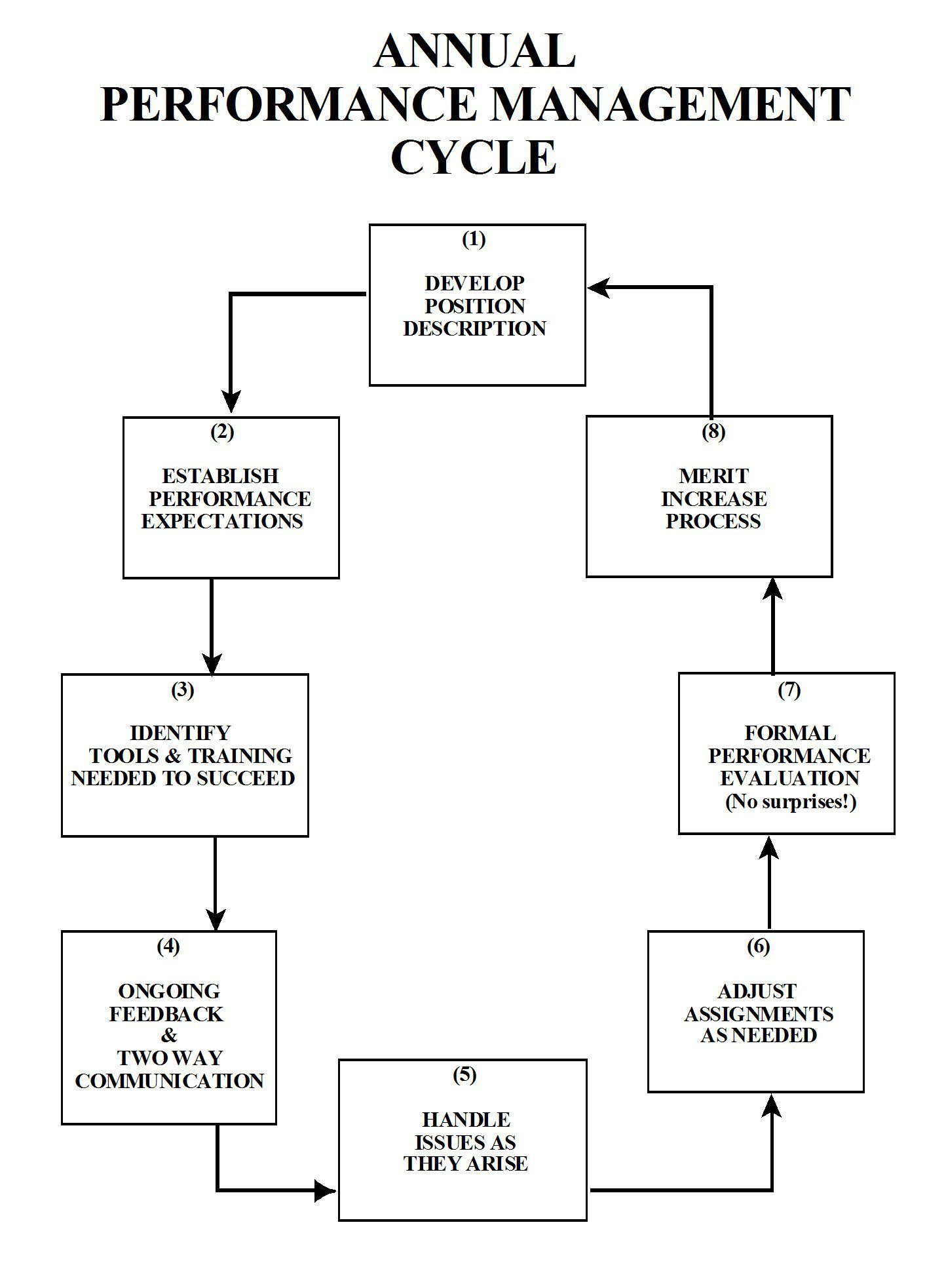

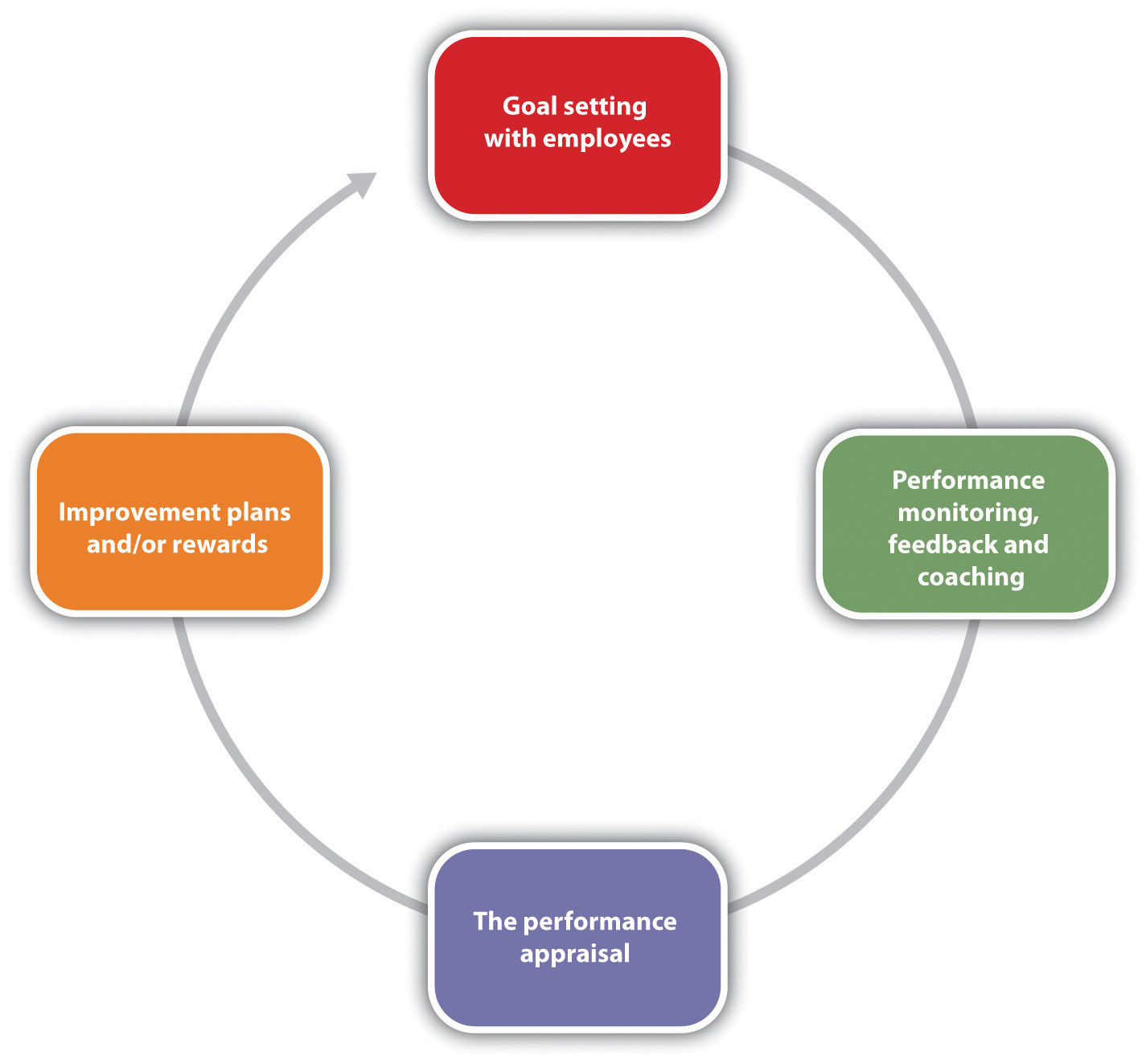

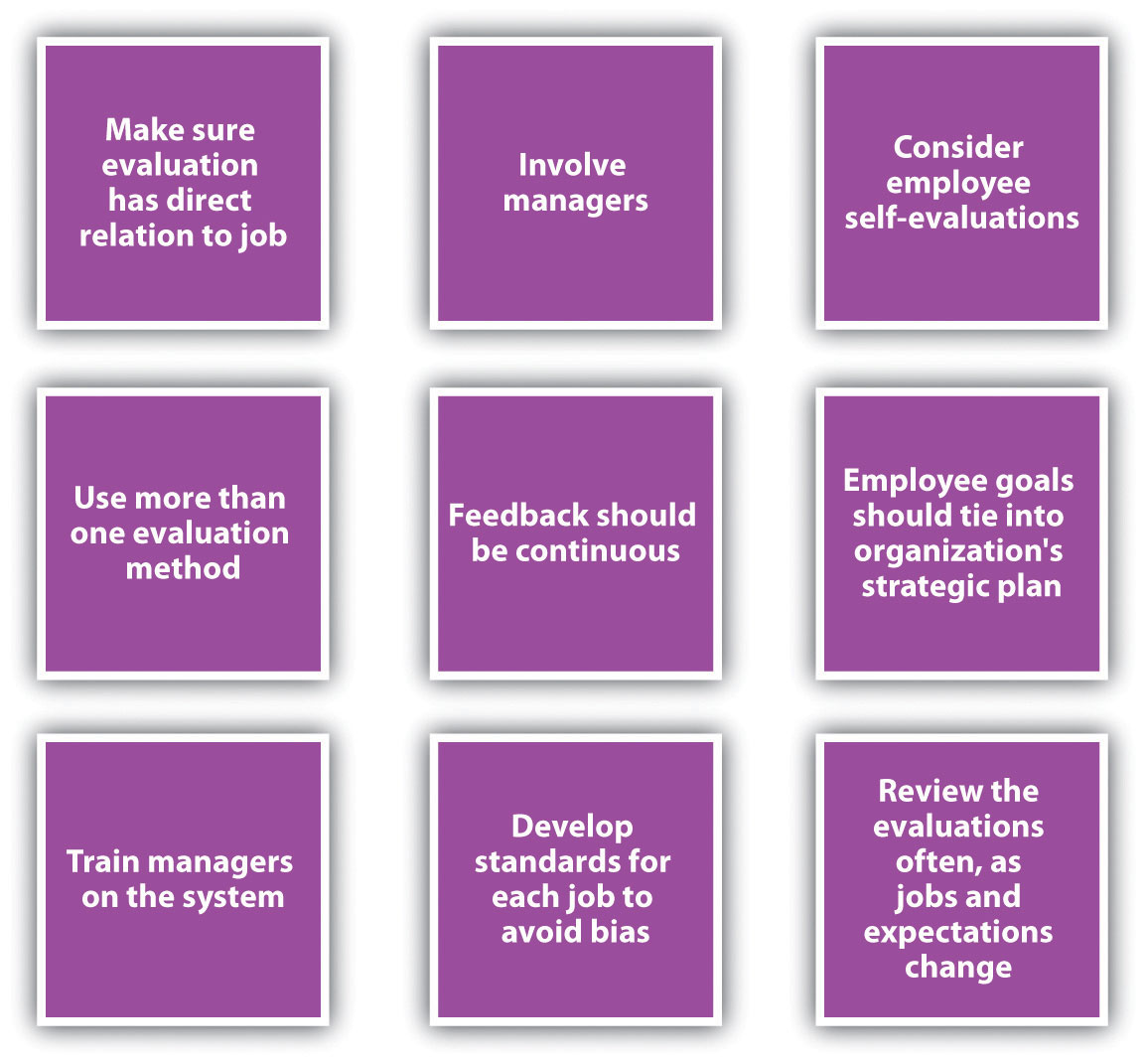

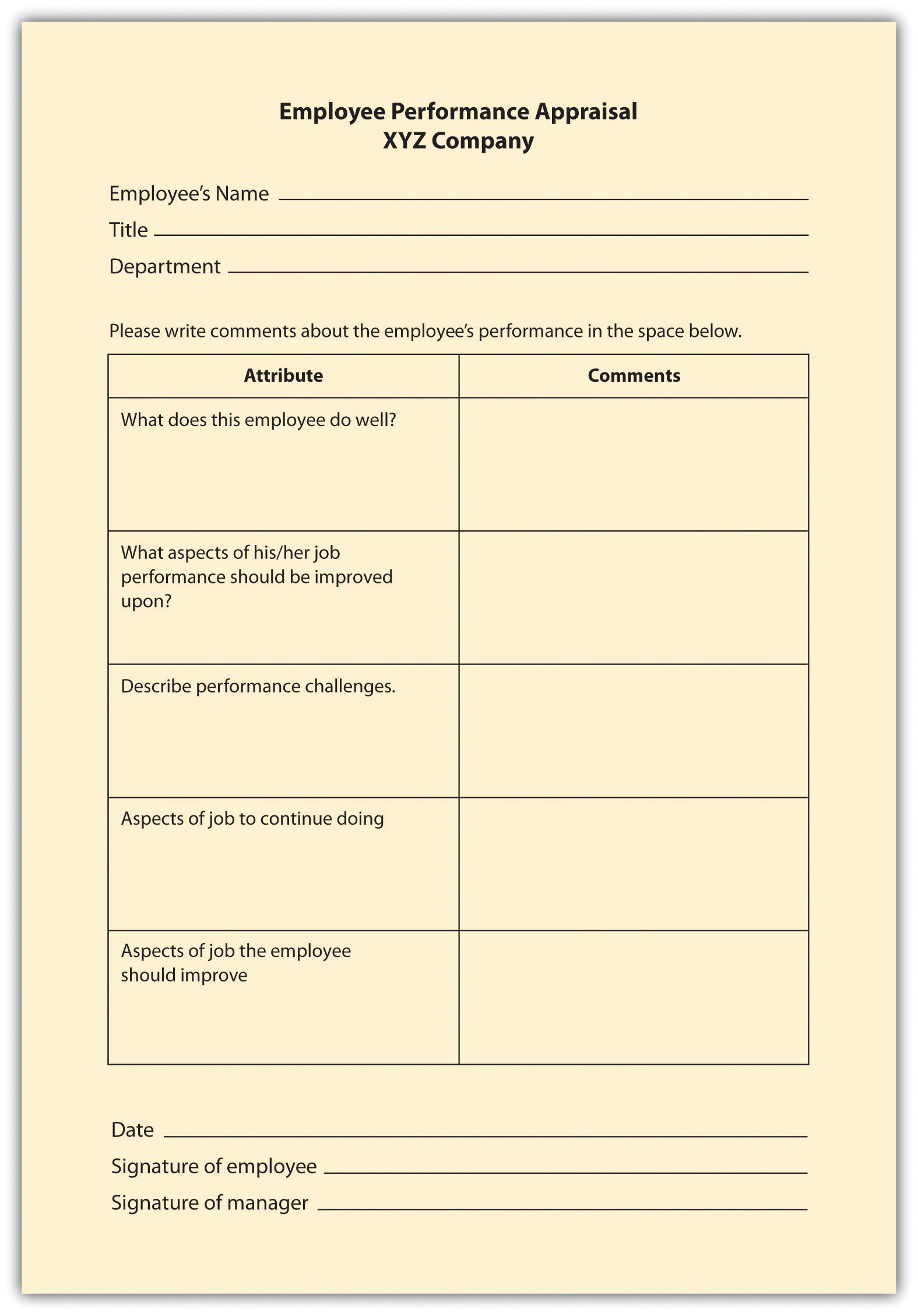

On the appraisal form, and suggest actions and training or development to improve performance. If there are different comps to be provided they can be submitted. The topic is how to handle low appraisal.

Your loan will cover only the appraised. A low appraisal can affect every aspect of a pending contract on a home. As part of your offer, you tell.

It's disheartening when a house appraisal comes back lower than the purchase price you and the seller agreed on.